Ulises Sepúlveda Déniz // Shutterstock

Written by Chris Horymski

Credit cards are an integral part of the 21st-century economy. There are well over half a billion credit card accounts, according to Experian data. Through these accounts, U.S. consumers drive more than $4.5 trillion in purchases of goods and services annually, according to a recurring study from the Federal Reserve.

That spending is great for economic growth: Consumer spending is responsible for about 70% of the nation’s gross domestic product. But the flip side of this increased economic activity is growing credit card balances. As of the third quarter (Q3) of 2023, consumers collectively owed more than $1 trillion on their credit cards. Although incomes are up, and jobs have been generally plentiful for more than two years, the 10% increase in average credit card balances, to $6,501, reflects changing consumer habits as well as elevated interest rates and inflation that’s still affecting pocketbooks.

Looking at consumer credit and debt trends in 2023, Experian examined what’s driving the increases in credit card balances.

Overall Credit Card Debt Increases to Nearly $1.07 Trillion in 2023

Total credit card balances grew by $157 billion to end Q3 2023 at nearly $1.07 trillion. The 17% increase from Q3 2022 was spread over a larger credit card account base, which grew more than 8% over the same period.

There are close to 569 million credit card accounts as of Q3 2023, 62 million more than the prior year.

Experian

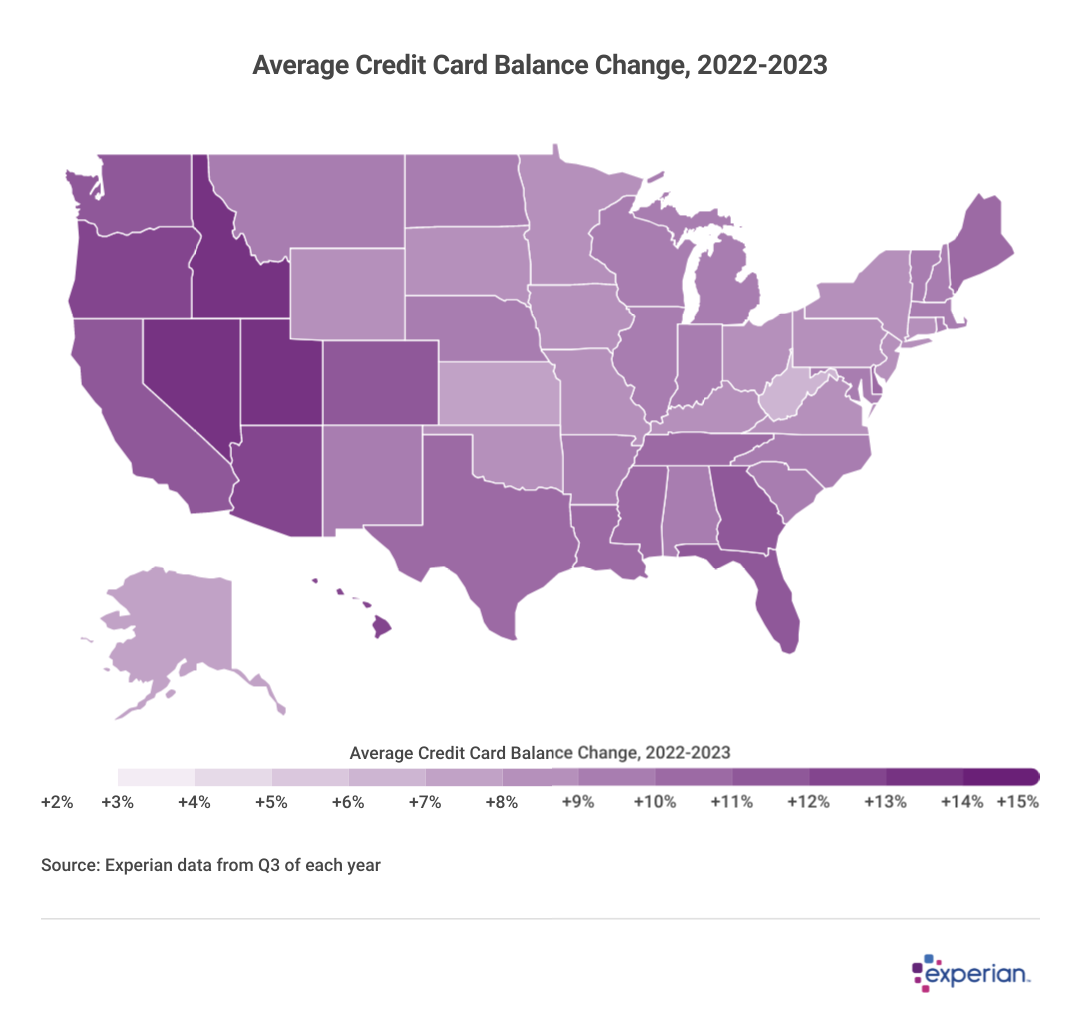

Average Credit Card Balances by State Increased From 7% to 13%

With the national average credit card balance up exactly 10% over the past year, it’s easy to find those states with faster-growing debt in the map. States where consumers are amassing credit card debt faster than the national average have double-digit percentage growth rates of average balances, while those with more measured credit usage overall saw less than the 10% average annual increases. Even in these states, however, the increases in average balances were often 8% or 9% higher.

As with other types of consumer debt, including mortgages and auto loans, average credit card balances increased more rapidly in the Western U.S., with every state west of the Rockies (save sparsely populated Alaska and Wyoming) swelling average balances by at least 11% in 2023.

Other warm spots include some Southern U.S. states like Florida, Georgia, Tennessee and Texas, all of which increased average balances by more than 10% in 2023. The rest of the U.S., while not adding quite as much to their average balances, increased credit card balances by 7% to 9% in 2023.

Average Credit Utilization Inches Up

The average credit utilization ratio among consumers climbed to 29% in 2023, a result of average balances growing faster than average credit limits.

Utilization is a significant factor in credit score calculations. Lower is always better when it comes to a good credit utilization ratio, as the table below illustrates. If you keep your utilization below 30%, carrying a balance shouldn’t be too detrimental to your FICO Score.

Still, utilization is only one of several factors influencing an individual’s credit score. Length of credit history, the types of credit used and new credit all influence FICO Score calculations as well (though not as much as utilization or payment history).

Experian

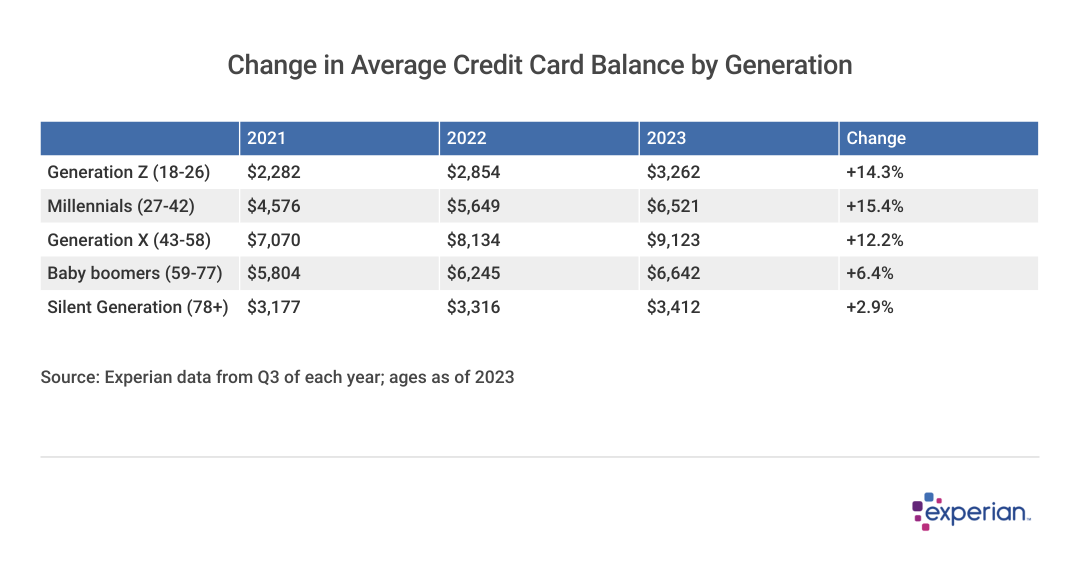

Millennial Credit Card Debt Grew Fastest, But Gen X Debt Was Greater

In 2023, the average credit card balances of millennials increased by 15.4%, the most of any generation. Their average balance of $6,521 is now virtually the same as the average balance of all U.S. consumers.

However, Generation X has more credit card debt than other generations, and by a large margin. The average Gen X credit card balance of $9,123 exceeds the nationwide average of $6,501 by more than 40%.

Experian

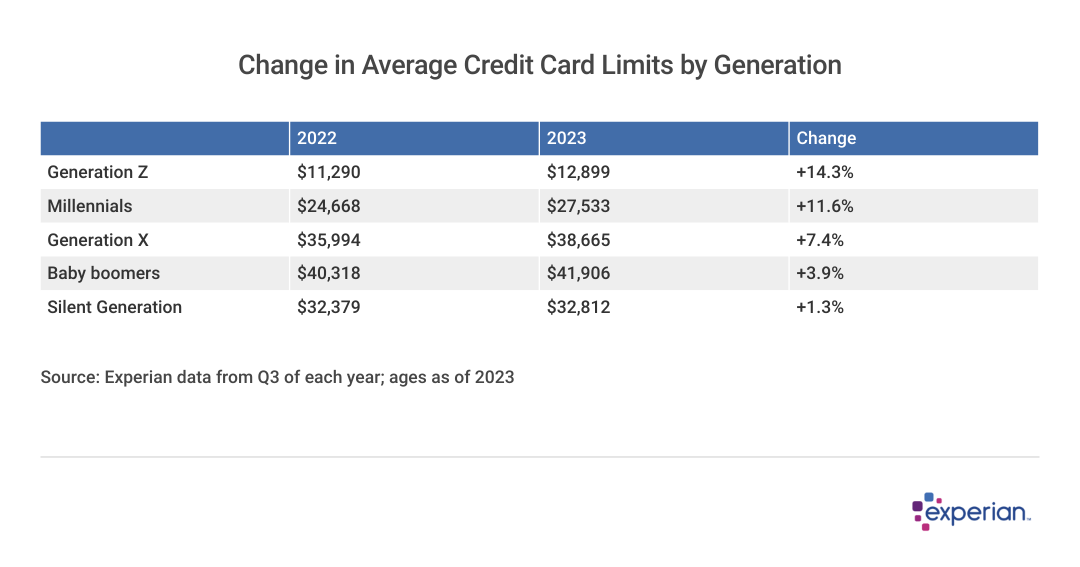

Credit Limits Increased Across All Ages

Overall credit limits—the total amount of credit extended across an individual’s revolving credit lines—increased among all generations, indicating that lenders, for now, are still willing to extend credit to many consumers. Even if the extra credit isn’t needed, an increase in available credit still can help to lower one’s credit utilization, which in turn could improve credit scores.

Nonetheless, this still presents a challenge for consumers in 2023 and beyond. When average balances increase by more than average credit limits, we can conclude average credit utilization has also increased for each generation in 2023. Potentially, it could result in downward pressure on FICO Scores. Although there are many factors at play when calculating a credit score, a higher credit utilization level can generally result in a lower FICO Score, which could influence the availability of future credit to individuals.

Experian

Higher Monthly Bills May Be Impacting Credit Card Balances

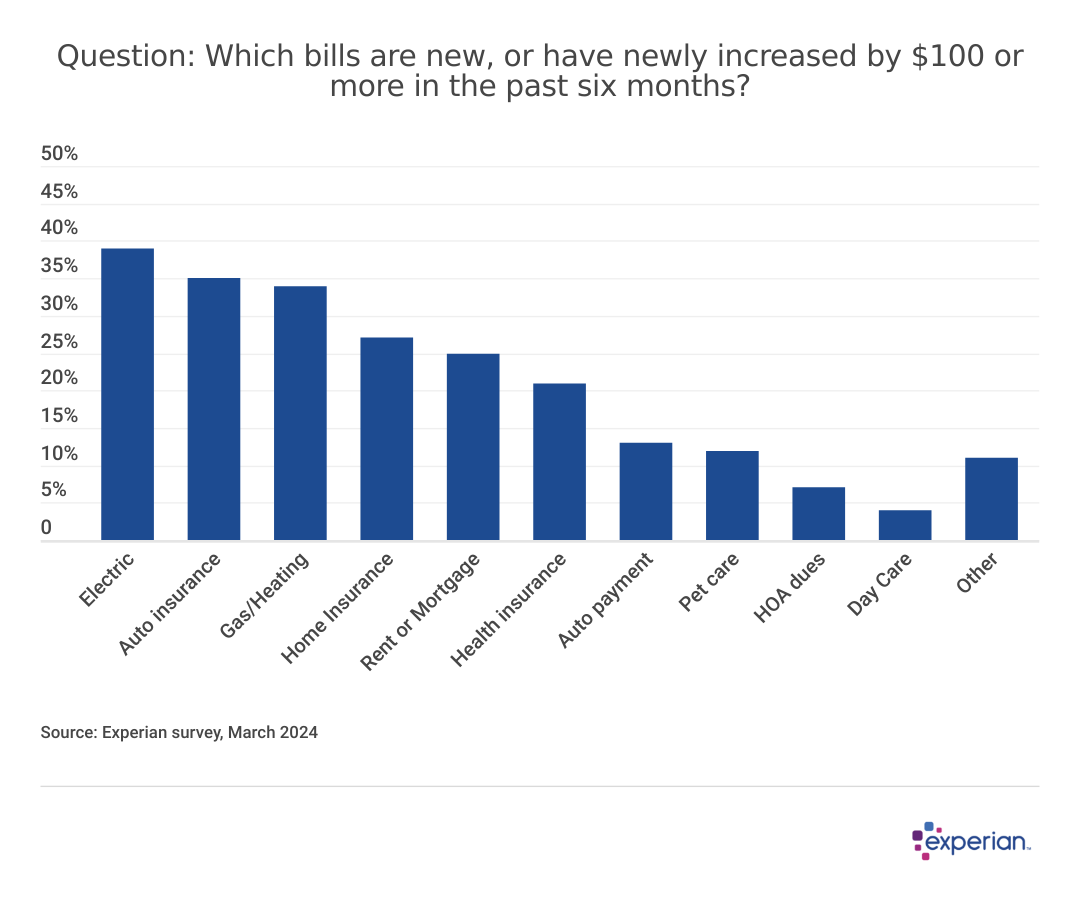

To learn more about the factors affecting credit card usage, Experian surveyed 1,237 credit card users in early March about their credit card spending and balances. Most survey respondents (58%) indicated that their monthly bills have recently increased significantly. Among them, 75% said new or increased bills have impacted their ability to pay down their credit card balances.

The most common culprits were insurance premiums (both homeowners and auto insurance) and utilities (both electric and heating).

This, combined with higher interest rates for existing credit card balances, appears to be squeezing many consumers, resulting in less cash to pay down their current credit card balances. Nearly half of consumers (44%) say they’ve noticed larger credit card balances, with just 16% saying their balances are lower than they were six months ago.

Credit Card Trends to Look Out For in 2024

Consumers may be more likely to use credit cards to pay monthly bills. Speculation is that new and larger monthly bills are forcing some consumers to rely on credit cards to make up for a shortfall of income month over month. In no particular order, consumers have plenty of costs to manage: higher home and auto insurance premiums, new student loan monthly repayments, as well as higher interest rates on auto loans and credit cards. So it’s hardly a surprise when more consumers begin to use credit cards to bridge any monthly shortfall between monthly income and an increased cost of living.

Fed survey suggests that credit for credit cards is still flowing, but slowing. The most recent temperature take of financial loan officers suggests that banks are being pickier, but will still lend. Banks reported offering lower credit limits, requiring higher minimum credit scores and demanding a higher annual percentage rate (APR) in exchange for offering unsecured credit to consumers.

Climbing APRs and balances only makes refinancing even more compelling. With average credit card APRs already topping 20%, according to Federal Reserve data, those able to refinance existing revolving debt may feel the urgency to do so this year. Balance transfer cards allow borrowers to pay down existing balances at an introductory 0% or reduced APR for a number of months—often 12 months or longer. Consider the average balance of $6,501: A consumer making a minimum payment of around $118 on a card with a 20% APR would be charged over $1,000 in interest over the course of 12 months, while barely making a dent in the balance. Debt consolidation loans are another option.

This story was produced by Experian and reviewed and distributed by Stacker Media.